Are Texas property taxes overwhelming you?

As a homeowner in McLennan or Bell County, you may be eligible for exemptions that can lower your property tax bill by up to 20%. At Property Tax Help, we're dedicated to guiding local residents through the process and maximizing their savings.

Why Understanding Property Taxes is Crucial for McLennan & Bell County Homeowners

To maximize your savings, it’s essential to understand the appraisal and appeals process, as they impact your property tax assessments. Let’s break it down step-by-step.

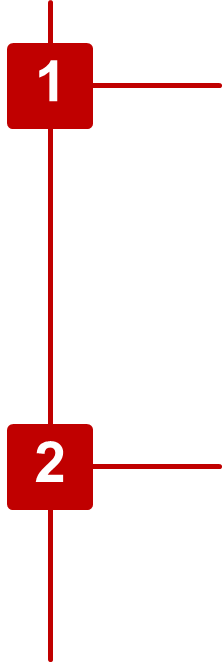

The Appraisal Process in Texas: A Step-by-Step Guide

(January-May)

January 1st

Every year on January 1, your property's market value is appraised by your local Appraisal District, managed by a chief appraiser. This valuation determines your property tax bill.

April-May

Property Appraisal Value Notices are sent between April and May.

The Appeals Process in Texas: Know Your Rights

(May-August)

You are entitled to fair and uniform taxation based on your property's market value. If you disagree with the appraised value, the appeals process provides an opportunity to seek a fair appraisal.

How to Appeal Property Taxes:

1. Assess Your Property's Value: Check for recent improvements or market changes that might affect your property's appraised value.

2. File a Protest: Property Tax Help can file and protest on your behalf if you believe your property’s value has been appraised incorrectly.Key Deadlines:

- For most properties, the deadline to file your protest is May 15, or within 30 days of receiving your appraisal notice, whichever is later.

Unlocking Property Tax Exemptions in Texas

Texas property tax exemptions can significantly reduce your tax liability. By taking advantage of these exemptions, you can lower your property tax bill and retain more of your hard-earned money.

Available exemptions for Homeowners

Need Help Determining Which Exemptions You Qualify For? Property Tax Help is here to guide you through the process.

Payment Options and Deadlines

When are your Property Taxes due in Texas?

Property taxes are due by January 31 of the following year. If you miss this deadline:

Penalties and interest will accrue from February 1.

Certain further protest options will not be available if taxes are not paid by the due date.

When and how to pay your Property Taxes?

You have several convenient options to ensure your payments are made on time:

Online: Online payment through your county’s website.

Mail: Mail payment to your county tax assessor's office.

In Person: Pay in person at your county tax office.

Final Thoughts

Understanding Texas property taxes can save you money and prevent penalties. By taking advantage of exemptions, appealing inaccurate appraisals, and making timely payments, you can manage your property taxes effectively.

Get Started Today

McLennan & Bell County local homeowners, take control of your Texas property taxes and start saving money. Contact Property Tax Help today by:

Filling Out Our Contact Form: Send us your questions/concerns.

Call (254) 640-0057: Personalized guidance.

Share this post: Help others unlock Texas property tax savings.