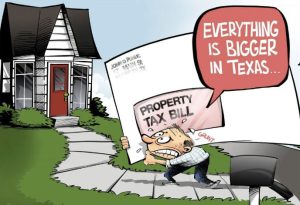

Imagine receiving a property tax bill and realizing you’re just days away from a missed deadline. Navigating property tax deadlines in McLennan and Bell County is crucial for avoiding costly penalties and legal issues. Here’s a straightforward guide to help you understand when your property tax bill is due and what steps to take if

Personalized Service and Local Expertise

Unlike large firms, we take the time to understand your situation, ensuring a customized approach that delivers results aligned with your specific needs.

Decades of Experience and Proven Results

With over 50 years of experience in property tax consulting, we bring knowledge and expertise to every client engagement.

Community Support

Through donations to various local organizations, we actively support making our community better.

"We’ve used PTH for both business and residential property taxes since 2019. Their expertise and attentive service have saved us money. PTH is an outstanding local business we trust and highly recommend."

-Rene & Bryan

"I’ve been a client for several years. My tax evaluations skyrocketed, and there’s too much at stake not to seek professional help. The Musgraves are well-prepared for the appeals process, earning my repeat business."

-Aubrey

"I highly recommend PTH for all property tax needs. They’re thorough and knowledgeable about McLennan County’s appraisal district. I’m extremely pleased with the results and have referred many friends."

-Kathy

"PTH is a lifesaver! Their team is knowledgeable, patient, and professional. They make the overwhelming property tax process seamless, saving time, money, and stress, while keeping you informed every step of the way."

-Summer

Latest From Our Blog

Don’t Miss Your Texas Property Tax Protest Deadline!

Don’t let a missed deadline cost you thousands! Property owners in McLennan and Bell County, act now to protest your tax appraisal and potentially save big.Understanding Key DeadlinesYour Texas property taxes are based on the value assessed by your local Appraisal District. If you believe this value is too high, you can file a protest.Notice

Reducing Your Texas Residential Property Taxes: A Simplified Guide

Owning property in McLennan and Bell Counties comes with benefits, but high property taxes can limit your financial flexibility. Fortunately, recent law updates and exemptions offer relief. This guide simplifies the process, helping you navigate exemptions, law changes, and deadlines to lower your property tax bill.Recent Changes in Property Tax LawsIn 2023 Texas updated its